Elon Musk’s Crypto Manipulation Is Not Just for Laughs

“One word: Doge.”

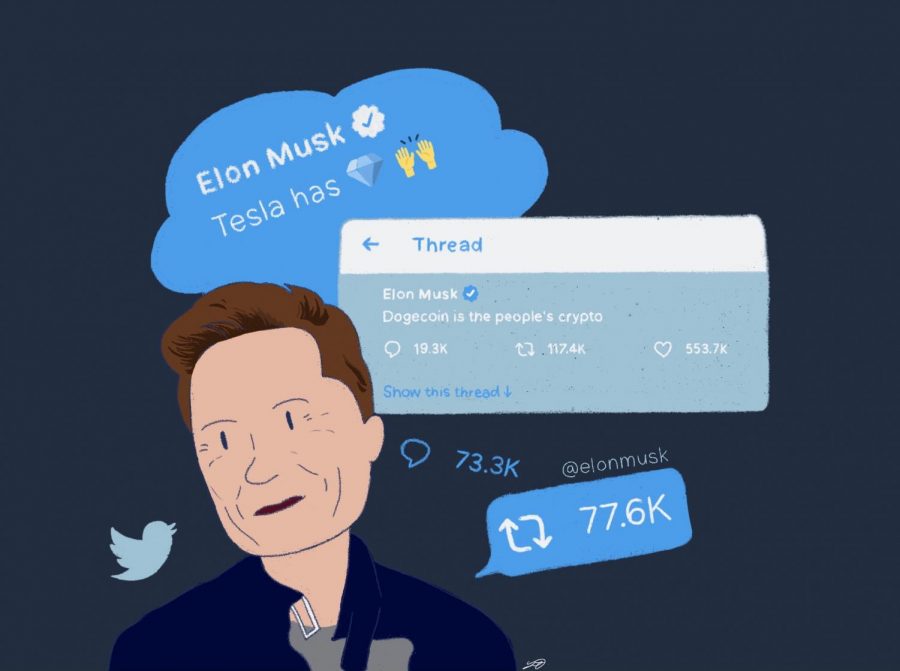

Like a magic spell, Elon Musk’s tweet on December 20th, 2020 sparked a 20% price increase in the digital currency Dogecoin. After electric cars, spaceships, and renewable energy, the rocket-scientist billionaire’s new interest is cryptocurrency. While some view Musk as a champion of this revolutionary payment technology, his impulsive public comments have instead destabilized the cryptocurrency market and harmed numerous institutional and everyday investors.

On February 8th, 2021, Tesla, one of Musk’s companies, announced its purchase of $1.5 billion of Bitcoin, 7.7% of the company’s total corporate cash. This purchase made Tesla the second-largest corporate owner of Bitcoin and also lent legitimacy to the cryptocurrency’s real-word utility. Bitcoin prices soared, reaching a peak of over $63,000 in mid-April. Musk’s powerful public influence and Twitter following of over 55 million have put him into the spotlight of the cryptocurrency world, and now, with fewer than 280 characters, he can push or lower the prices of Bitcoin or Dogecoin at will.

Musk began fueling the cryptocurrency craze on January 29th, 2021, adding #bitcoin to his Twitter biography and pushing Bitcoin prices up 20%. On February 4th, he tweeted, “Dogecoin is the people’s crypto”, pushing Dogecoin prices up 50%. After several years of dormancy, cryptocurrency once again caught the public eye. Prices soared and online users posted mutual encouragement to buy: “diamond hands”, “HODL”, “to the moon!”

Musk’s strong public influence, however, is a double-edged sword. Even his slightest public comments about cryptocurrency can sway the market in a radically negative way. On May 9th, Musk appeared on Saturday Night Live and quipped that Dogecoin was “a hustle,” causing a frantic selling spree that resulted in a 29.5% price drop. This was followed three days later by an announcement that Tesla would no longer accept Bitcoin as payment, a U-turn from three months earlier when Tesla introduced its new cryptocurrency payment system. Musk attempted to salvage the downward spiral of Bitcoin prices by tweeting on May 19th, “Tesla has diamond hands,” indicating that Tesla did not sell its entire portfolio. Nonetheless, prices continued to plummet, hitting a nadir of less than $35,000. Clearly, Musk has had an outsized impact on the cryptocurrency market.

The wild price fluctuations that Musk caused unfortunately have real-life consequences. For example, many everyday followers who blindly followed Musk’s lead lost life savings in cryptocurrency. Many other investors have borrowed money on their Bitcoin investments, so when prices plummet, they are forced to sell in order to pay back their debt. This exacerbates the situation, since a slight dip caused by Musk’s comments can expand into domino-effect crashes.

Musk’s tweets have also debased the mainstream utility of cryptocurrencies. Businesses have long been reluctant to accept Bitcoin due to its unpredictable price fluctuations, and Musk’s heavy influence on the cryptocurrency market has further damaged the people’s trust in this developing payment technology. Although Musk’s followers can be criticized for their lack of personal judgement, Musk’s comments were nonetheless inappropriate, inflating the cryptocurrency bubble and damaging the integrity of an already volatile market. For example, Dogecoin, a cryptocurrency that originally started as a joke in 2013, has no intrinsic differentiating technology, and therefore should not logically increase in price. But Musk has repeatedly posted about the cryptocurrency on Twitter, going so far as to name a new SpaceX satellite “Doge-1.” This has led many unwitting investors into dumping money into Dogecoin, fueling a Ponzi-scheme-like increase in price.

But Musk, despite his public influence and major companies, cannot forever maintain this price momentum. By May 19th, Dogecoin had already dropped 50% from its peak of $0.722 on May 7th to $0.368. Musk demonstrated a lack of responsibility for his public image and influence, and while Dogecoin may seem like a running gag to him, his tweets have caused millions of dollars to evaporate, misleading investors into the trap of a redundant cryptocurrency.

Despite Musk’s monumental achievements in renewable energy, space travel, and even city engineering, his recent reckless behavior has created a cryptocurrency fiasco. Whether his motivations were to attract attention, exert influence, or simply gain money, Musk neglected the consequences his actions could bring to investors and the cryptocurrency market. Unlike Dogecoin, the millions of dollars Musk’s tweets have evaporated are not a joke, and he should be held accountable for the irresponsible market damage his tweets have caused.

Editor-in-Chief