While driving around the Town of Groton, you may catch sight of signs skewered on the side of the road, bearing the slogan “Pay Your Fair Share” in all caps above the logos of Groton School and Lawrence Academy.

These signs, as their slogan suggests, have appeared in light of a movement dubbed “Pay Your Fair Share,” which targets tax-exempt nonprofit organizations in Groton—namely, Groton School, Lawrence Academy, and Groton Hill Music School—to offset their costs to the town by paying taxes. On August 22, 2024, Town of Groton resident Paul Fitzgerald published a letter in The Groton Herald, rallying Groton residents to protest in front of the Groton School campus during Parents Weekend on October 19.

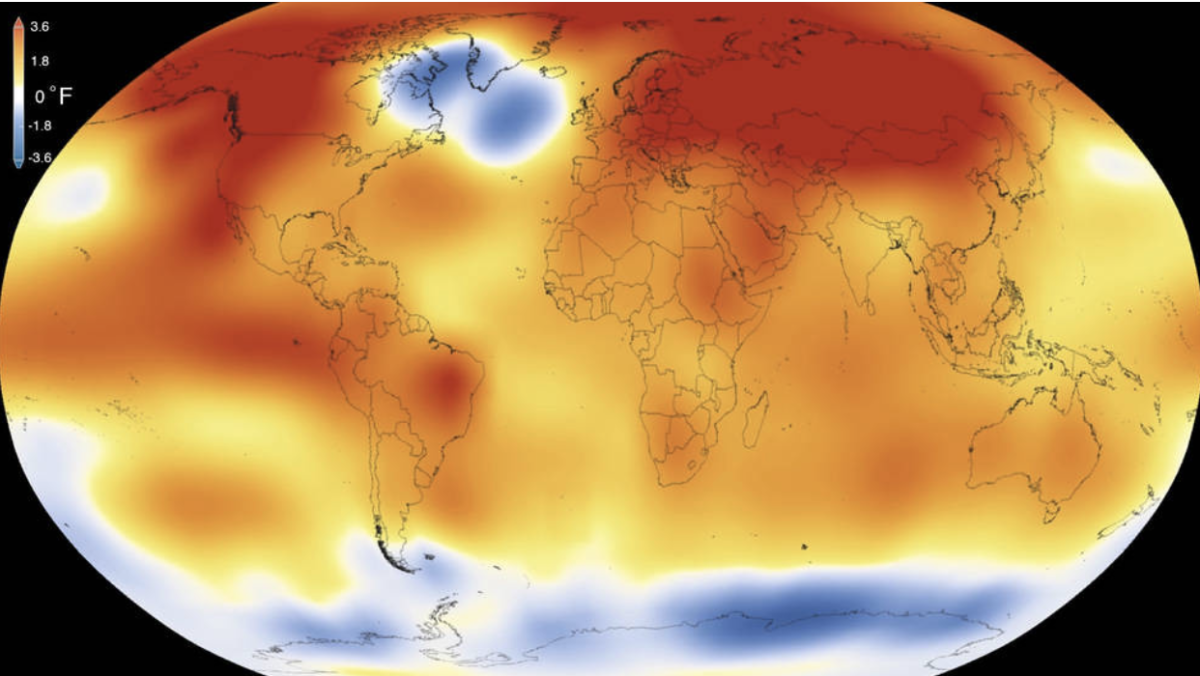

The “Pay Your Fair Share” movement arose after the Town of Groton, in response to falling revenue, attempted a March override of Proposition 2½, a 1980 Massachusetts law that “limits the total amount of taxes that a town can raise and increase in any given year.” After voters overwhelmingly defeated the override, some residents questioned why wealthy nonprofits, instead of townspeople, were not being pressured to contribute more to the town budget.

Without the proposed $5.5 million override, a decrease in the town’s school funding through Chapter 70—Massachusetts’s program for distributing aid to public schools—meant the Groton-Dunstable Regional School District (GDSRD) was forced to lay off 27 teachers.

Groton School is a 501(c)3 nonprofit organization, a national designation given to educational institutions. As a result, it is exempt from paying property taxes on the approximately $200 million worth of land it owns on and around campus. There are 509 tax-exempt organizations in Groton alone, but Groton School—due to the property it owns and the school’s large endowment—has been especially targeted by the movement.

Groton School’s direct expenses toward Groton stem from several sources: primarily, the current enrollment of 26 property tax–exempt faculty members’ children in the GDRSD school system and calls to the police and fire department.

However, despite being tax exempt, Groton School has made cash contributions to the town every year since 1998. During that time, Groton has contributed $10.1 million and donated $7 million worth of land to the town, according to Dean of Strategic Operations Kate Machan. These payments are entirely voluntary, helping to maintain the partnership between the town and school, as Mrs. Machan explained.

Groton Town Manager Mark Haddad firmly disagrees with the “Pay Your Fair Share” objective, saying that the protesters “had the best intentions” but that it was unrealistic and unfair to pressure Groton School to give more.

“Why aren’t I pushing the schools to do more?,” said Mr. Haddad. “Because they have done more. They gave me an additional $25,000 to buy equipment for the new fire station. They gave me $35,000 for new sidewalks around the public school campus.”

According to both Mr. Haddad and Mrs. Machan, a study conducted among 22 Massachusetts towns with private schools revealed that Groton School was among only three or four schools that contributed financially; the rest paid no money whatsoever to their respective towns. Mr. Haddad also added that he believed in “diplomacy” between the school and the town and that pushing the school for more donations could disrupt the existing financial relationship between the two entities.

“The town needs to work within the law,” he said. “I can’t make up laws. I can’t make up press releases. The law says that Groton School is tax exempt and they don’t have to pay taxes on their property.”

As for the financial deficits created by Groton’s faculty kids who attend public schools within the GDSRD while simultaneously living in tax-exempt housing, the protesters’ proposed solution of having Groton School pay money per child towards the town is not realistic or sustainable, according to Mrs. Machan. It is impossible to match Groton School’s gifts and services penny for penny to their expenses toward the town. Much of the school’s endowment is not liquid and cannot be extracted and used at will. Additionally, protesters also do not consider the 10 Groton students who reside in the town of Groton but are not faculty students and whose families pay taxes toward the town while not utilizing the public school system.

The Town of Groton’s financial situation is a complicated issue without any simple solution. The town’s budget problems stem from multiple sources, notably a lack of state aid, and asking Groton School and Lawrence Academy to make up this deficit is simply an unviable solution. Nevertheless, it is important that Groton students, faculty, and staff recognize the many factors that caused the “Pay Your Fair Share” movement to arise.